A recent arbitration matter under Section 73A of the Basic Conditions of Employment Act 75 of 1997 (the BCEA). The dispute related to an alleged underpayment in terms of the National Minimum Wage Act 9 of 2018 (the NMWA). In terms of the NMWA, an employer may not pay any employee less than the prescribed minimum wage for time worked.

The nature of the employer’s business was that of microlending, with sales representatives employed and responsible for securing new business.

In terms of the National Minimum Wage Act 9 of 2018, an employer may not pay any employee less than the prescribed minimum wage for time worked. The aforementioned is unambiguous, but can an employer pay an employee a basic salary which is less than the minimum wage, or even no guaranteed basic salary, provided that the commission earned by the employee exceeds the minimum wage as prescribed by the Act? This is what had to be determined in Atlas Finance (Pty) Ltd v CCMA & 2 others, 2022 JR57/21.

On review the Labour Court ruled:

Acting Judge Deane agreed and held that commission is not a discretionary payment, which is not related to an employee’s hours of work, but forms a part of the employee’s wages and that the intention was not to exclude commission from the NMW. However, commission workers must still be paid at least the NMW. Workers do not have to be paid the minimum wage for each hour worked, but they must be paid the minimum wage, on average, for the time worked in a pay reference period.

It was, furthermore, held that the Commissioner misdirected himself by failing to take into account the evidence placed before him showing that the employees were paid in excess of the NMW. He further misdirected himself by failing to consider that the employer acknowledged that employees whose basic salaries and commission payments were not sufficient to ensure compliance with the NMWA, were, as required per Section 5(3) of the NMWA, topped up to ensure compliance.

The Commissioner’s decision to exclude commission earned by the employees in determining whether the applicant indeed complied with the NMWA was not a reasonable decision and constituted a material error of law.. It was ordered that the employer was not in breach of the NMWA by virtue of including commission earned in calculating the minimum wages of employees.

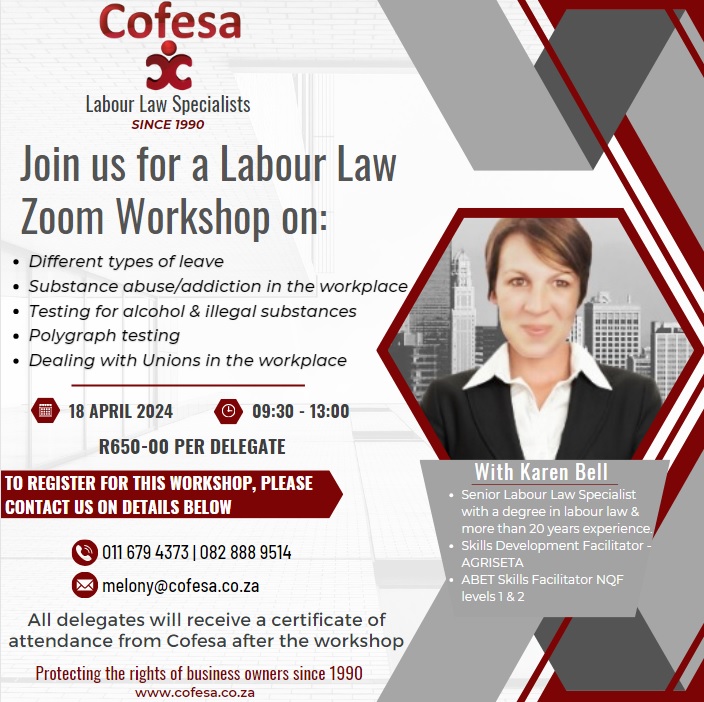

CONTACT THE COFESA 24-HOUR HELPLINE FOR ASSISTANCE

011 679 4373 | ETIENNE@COFESA.CO.ZA

Source: Jan du Toit is a director at Labour Guide